In the dynamic world of Forex trading, where fortunes are made and lost in the blink of an eye, traders constantly seek strategies to gain an edge in the market. Among the plethora of tools and techniques available, one stands out for its simplicity and effectiveness: Forex trading with trend lines. Understanding how to leverage trend lines can provide traders with valuable insights into market direction and potential trading opportunities. In this comprehensive guide, Forexsfxgroup delve into the intricacies of Forex trading with trend lines, exploring its principles, methodologies, and practical applications.

Introduction to Forex Trading with Trend Lines

Forex trading with trend lines is a fundamental strategy employed by traders to identify and capitalize on price trends in the currency markets. A trend line is a graphical representation of the direction of price movement over a specific period, typically drawn by connecting consecutive highs or lows on a price chart. These lines serve as visual guides, aiding traders in discerning the prevailing market sentiment and potential future price movements.

Understanding Trends and Trend Lines

Before delving into the application of trend lines in Forex trading, it’s essential to grasp the concept of trends. Trends reflect the general direction in which prices are moving and can be categorized as upward (bullish), downward (bearish), or sideways (range-bound). In an upward trend, prices form higher highs and higher lows, indicating bullish momentum. Conversely, a downward trend is characterized by lower highs and lower lows, signaling bearish sentiment. Sideways trends, on the other hand, depict a lack of clear directional bias, with prices oscillating within a horizontal range.

Trend lines are drawn to visually represent these trends on price charts. For an uptrend, trend lines are drawn by connecting successive higher lows, forming a rising support line. In contrast, for a downtrend, trend lines are drawn by connecting successive lower highs, creating a descending resistance line. In a sideways market, trend lines are drawn to encapsulate the upper and lower boundaries of the price range.

The Role of Trend Lines in Forex Trading

Forex trading with trend lines revolves around utilizing these lines as key reference points for trading decisions. Trend lines serve multiple purposes in a trader’s arsenal:

- Trend Identification: Trend lines aid traders in identifying the prevailing market trend, whether it be bullish, bearish, or sideways. By visually mapping the highs and lows, traders can discern the direction of price movement and adjust their trading strategies accordingly.

- Entry and Exit Points: Trend lines provide valuable insight into potential entry and exit points for trades. In an uptrend, traders may seek buying opportunities as the price approaches the trend line, anticipating a bounce off the support level. Conversely, in a downtrend, traders may consider selling opportunities near the trend line as it acts as a resistance level. Additionally, trend line penetrations can signal potential trend reversals or breakout opportunities, prompting traders to enter or exit positions accordingly.

- Risk Management: Effective risk management is paramount in Forex trading. Trend lines enable traders to establish appropriate stop-loss levels to mitigate potential losses in the event of trend reversals or breakouts. By placing stop-loss orders below support levels in uptrends or above resistance levels in downtrends, traders can limit their downside risk while maximizing potential profits.

Implementing Forex Trading Strategies with Trend Lines

Forex trading with trend lines encompasses various trading strategies tailored to different market conditions:

- Trend Following: In this strategy, traders aim to capitalize on the prevailing market trend by entering positions in the direction of the trend. For example, in an uptrend, traders may wait for price retracements towards the trend line before initiating long positions, anticipating a continuation of the upward momentum.

- Trend Reversal: Contrarian traders employ trend lines to identify potential trend reversals. A break of a trend line accompanied by significant volume or other technical indicators may signal a reversal of the prevailing trend, prompting traders to enter positions in the opposite direction.

- Breakout Trading: Breakout traders focus on identifying instances where price breaks through a trend line, indicating a potential shift in market sentiment. Breakouts can lead to significant price movements, offering lucrative trading opportunities for those able to capitalize on them.

Advantages and Limitations of Forex Trading with Trend Lines

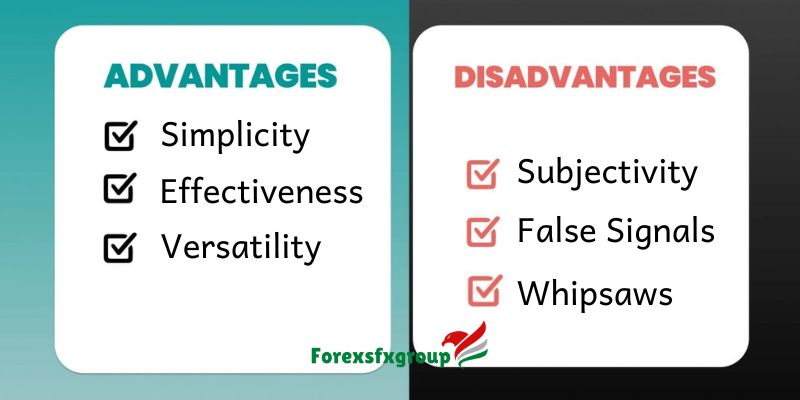

While Forex trading with trend lines offers several advantages, including simplicity, clarity, and effectiveness, it’s essential to recognize its limitations:

Advantages:

- Simplicity: Trend lines provide a straightforward visual representation of market trends, making them accessible to traders of all experience levels.

- Effectiveness: When used in conjunction with other technical indicators and fundamental analysis, trend lines can help traders make informed trading decisions and identify high-probability trading opportunities.

- Versatility: Trend lines can be applied to various timeframes and currency pairs, allowing traders to adapt their strategies to different market conditions.

Limitations:

- Subjectivity: The process of drawing trend lines involves a degree of subjectivity, as different traders may interpret price action differently, leading to variations in trend line placement.

- False Signals: Like any technical analysis tool, trend lines are not infallible and may produce false signals, leading to potential losses if not used in conjunction with other confirming indicators.

- Whipsaws: In volatile markets, trend lines may experience whipsaws, where price briefly breaches the trend line before reversing course, resulting in losses for traders who enter premature positions.

Conclusion: Mastering Forex Trading with Trend Lines

Forex trading with trend lines is a time-tested strategy that has stood the test of time. By understanding the principles of trend analysis, mastering the art of drawing accurate trend lines, and applying sound risk management principles, traders can harness the power of trend lines to gain a competitive edge in the Forex market. While no trading strategy guarantees success, incorporating trend lines into your trading arsenal can provide valuable insights into market dynamics and help navigate the complexities of currency trading with confidence.

In conclusion, whether you’re a novice trader embarking on your Forex journey or a seasoned veteran seeking to refine your trading strategies, mastering the art of Forex trading with trend lines is a worthwhile endeavor that can enhance your trading proficiency and potentially lead to greater trading success.

Forex trading with trend lines isn’t just a strategy; it’s a mindset—a disciplined approach to analyzing market trends, identifying trading opportunities, and managing risk effectively. By embracing this mindset and integrating trend line analysis into your trading routine, you can elevate your trading game and embark on a journey towards consistent profitability in the dynamic world of Forex trading.