Forex trading with moving averages has become a cornerstone strategy for traders seeking to navigate the dynamic foreign exchange market. This technical analysis approach utilizes moving averages to identify trends, potential entry points, and key market signals. Moving averages, whether simple or exponential, offer traders a visual representation of price trends, helping them make informed decisions. In this comprehensive guide, Forexsfxgroup will delve into the intricacies of Forex trading with moving averages, exploring various techniques and strategies that traders employ to gain a competitive edge in the ever-evolving Forex landscape.

Understanding Moving Averages

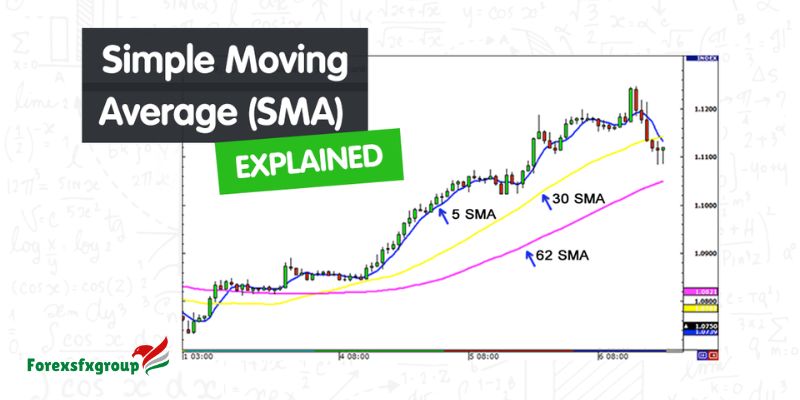

Moving averages are statistical calculations that smooth out price data over a specified period, creating a continuous line that represents the average value of an asset. Two common types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA gives equal weight to all prices over the chosen period, while the EMA assigns more weight to recent prices, making it more responsive to current market conditions.

Identifying Trends

One of the primary applications of Forex trading with moving averages is the identification of market trends. Traders analyze the relationship between the current price and the moving average to determine the prevailing trend.

In an uptrend, the price consistently trades above the moving average, signaling bullish market sentiment. Conversely, in a downtrend, the price consistently trades below the moving average, indicating bearish market sentiment. Traders can use this information to align their positions with the prevailing trend, increasing the likelihood of profitable trades.

Utilizing Crossovers

Crossovers are powerful signals generated when two moving averages intersect. The Golden Cross and Death Cross are two noteworthy crossover patterns that traders closely monitor.

The Golden Cross occurs when a shorter-term moving average crosses above a longer-term moving average. This event is often interpreted as a bullish signal, suggesting a potential upward trend in the market. Forex traders with moving averages incorporate the Golden Cross into their strategies as an opportune moment to enter long positions.

Conversely, the Death Cross transpires when a shorter-term moving average crosses below a longer-term moving average. Traders view this as a bearish signal, indicating a potential downward trend. Recognizing the Death Cross prompts traders to consider short positions or exit existing long positions to mitigate potential losses.

Identifying Support and Resistance Levels

Moving averages serve as dynamic support and resistance levels, influencing price movements based on their positions relative to the current market price. In an uptrend, the moving average may act as support, preventing prices from falling significantly below that level. Conversely, in a downtrend, the moving average may act as resistance, impeding upward price movements.

Traders incorporate these support and resistance levels into their decision-making process, using them to set stop-loss orders, determine profit targets, and identify potential trend reversals. Recognizing the significance of moving averages as dynamic support and resistance adds an extra layer of precision to Forex trading strategies.

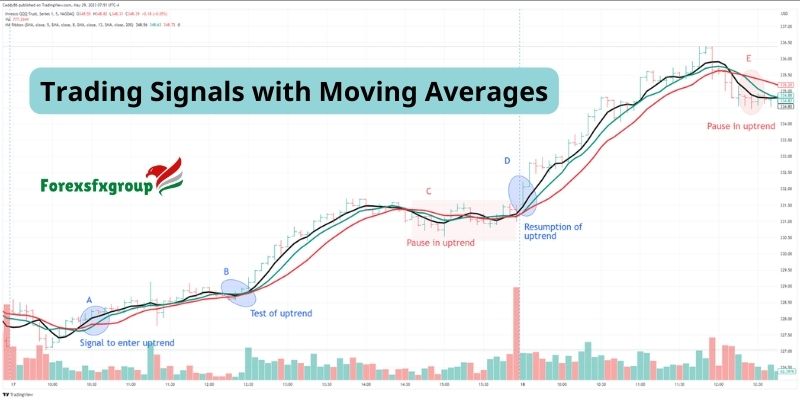

Trading Signals with Moving Averages

The interaction between different moving averages generates valuable trading signals, offering insights into potential entry and exit points. Traders often rely on crossovers between shorter-term and longer-term moving averages to trigger these signals.

When the shorter-term moving average crosses above the longer-term moving average, a buy signal is generated. This Golden Cross signifies a potential shift towards an uptrend, encouraging traders to consider opening long positions.

Conversely, when the shorter-term moving average crosses below the longer-term moving average, a Death Cross occurs, signaling a potential downtrend. This prompts traders to explore short positions or exit existing long positions, anticipating a decline in market prices.

Using Multiple Moving Averages

To enhance the accuracy of their analyses, many traders opt for a combination of moving averages with different periods. This approach provides a more comprehensive view of market trends, filtering out short-term fluctuations and highlighting more significant trends.

For instance, a trader might use a short-term, medium-term, and long-term moving average. When these moving averages align, reinforcing a consistent trend across various timeframes, traders gain confidence in their analyses. This multi-moving average strategy is particularly useful for confirming trends and avoiding false signals that may arise from short-term market volatility.

Fine-Tuning Strategies Based on Market Conditions

Forex markets are dynamic, and trends can change rapidly. Traders employing moving averages must be adept at adapting their strategies based on current market conditions. This involves regularly reassessing moving average parameters, adjusting timeframes, and incorporating additional technical indicators to refine trading decisions.

Moreover, traders should be mindful of potential false signals during periods of low liquidity or high volatility. In such conditions, relying on moving averages alone may lead to suboptimal outcomes. Combining moving averages with other technical indicators, such as oscillators or trendlines, can provide a more comprehensive analysis of market dynamics.

Risk Management and Position Sizing

Successful Forex trading with moving averages goes beyond identifying trends and signals; it requires effective risk management. Traders must implement sound risk management practices, including setting stop-loss orders and determining position sizes based on their risk tolerance.

Moving averages can assist in defining suitable stop-loss levels by identifying key support or resistance areas. By incorporating these levels into their risk management strategy, traders can mitigate potential losses and protect their capital.

Conclusion

In conclusion, Forex trading with moving averages is a versatile and widely adopted strategy in the dynamic foreign exchange market. Traders leverage moving averages to identify trends, generate trading signals, and manage risk effectively. The Golden Cross, Death Cross, and the utilization of multiple moving averages provide valuable insights into market dynamics, empowering traders to make informed decisions.

As with any trading strategy, it’s crucial for traders to combine moving averages with a comprehensive understanding of market conditions, risk management techniques, and continuous adaptation to changing trends. By mastering the art of Forex trading with moving averages, traders can enhance their ability to navigate the complexities of the Forex market and achieve long-term success.