Like any other investment sector, Forex trading has the potential to be lucrative. But only under the condition that the trader has a sound understanding of how the foreign exchange market operates and that they have a well-thought-out strategy in place. After all, correctly predicting the future direction of a currency pair is the only way how to be profitable in Forex market.

To put it another way, the Forex trader needs to create more lucrative deals than losing ones in order to be profitable. This is no simple task in the Forex market, especially as many seasoned traders will rely on sophisticated technical analysis to decide which trades to make. This entails researching currency pairs in an effort to forecast trends.

How To Be Profitable In Forex

There are numerous ways how to be profitable in Forex, but in this post we’ll focus on seven crucial approaches to advance:

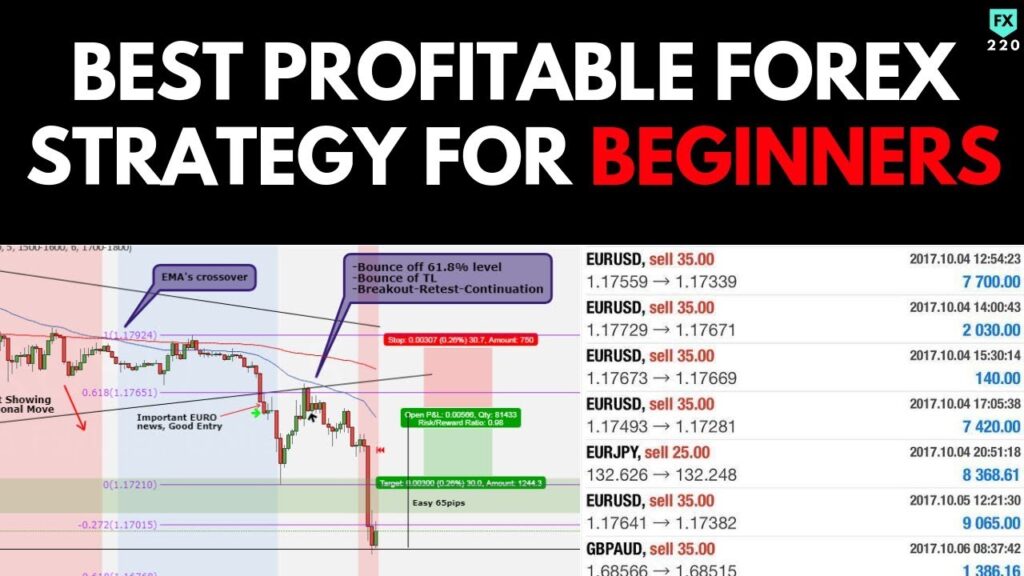

1. Selecting and evaluating a reliable trading strategy

It must be stated that selecting a trading style is the first logical step when talking about how to be profitable in Forex. There are various choices, but most of them fit into one of these groups:

- High frequency trading

- Swing trading

- Day trading

- News trading

- Scalping

- Long term trading

- Copy trading

The market offers a variety of opportunities for profit. However, not every strategy will work for every trader. A trading technique could be successful for one trader but unsuccessful for another. Each trader is unique. When you choose a trading strategy that matches your personality, you will trade consistently in the Forex market.

Scalpers profit from regional price fluctuations. High frequency traders execute a large number of deals daily. With the aid of trading algorithms, copy traders mimic other profitable traders. To avoid swaps, day traders open and terminate orders during a trading day. Swing traders don’t close out their open trades inside a 24-hour period. Fundamental research is primarily used by swing traders, and trades might take a few days to a few weeks to complete. Long-term investors and traders investing in tangible assets is typically preferred over CFD trading.

When there are so many trading approaches available, how can one maintain consistency in the Forex market? To determine which style is ideal for you, you’ll have to put in a lot of effort. Backtesting and demo trading are both very beneficial. Using a fictitious account balance, demo trading allows traders to experience a live trading environment. The vast majority of brokers give their customers free Demo accounts. As you compare trading methods with historical chart data during backtesting, it takes time away from the conversation.

Additionally, market conditions frequently shift. To trade Forex profitably, you must first understand the importance of building and modifying trading strategies.

2. Have a risk-to-reward ratio of at least 2:1 and a high success rate.

There are two main strategies you might use if you’re wondering how to be profitable in Forex.

If you use the first strategy, you can still turn a profit even if only 50% of your forecasts come true. Your risk to reward ratio must be one risk to more than one reward for that. Typically, traders choose a risk/reward ratio of at least 1:2. For instance, a trader would think about putting the stop-loss order below 50 pips of the current market price if their goal is to make 100 pips from a certain position. However, bear in mind that the setup, not your trading objectives, should determine the Stop Loss and Take Profit targets. You shouldn’t force a setup if it doesn’t give you an opportunity.

Having a prediction success rate of more than 50% is the second strategy for consistently increasing your trading winnings. In this manner, the strategy will result in account balance growth over a specific number of trades, even if the risk to reward ratio is 1:1.

3. Establishing reasonable profit goals

We must first learn how to set reasonable expectations before we can learn how to be profitable in Forex. If your expectation is to double your deposit each month, you’ll take unnecessary risks and jeopardize the sum in your account. Additionally, you must educate yourself on the instruments you plan to trade.

Each currency pair’s average daily volatility is unique. For instance, due to the strong correlation between the two currencies, EUR/CHF typically rises by 50 to 55 pip on average. Therefore, setting a daily profit goal of 100 pip with this pair may not be practical. Other currency pairs, like GBP/AUD or GBP/NZD, with daily movements that may range between 190 and 210, are more suited for such ambitious ambitions.

4. Staying away from using high leverage

The finest Forex strategy for steady gains should incorporate risk control. Leveraged trading entails greater risk. The maximum leverage available from several highly regulated brokers is 30:1 or 50:1. And it simply implies that you can receive a deposit with up to 50 times the purchasing power. The fact that many financial commentators refer to leverage as having two sides is not merely a coincidence. The issue is that excessively leveraged trading might quickly result in catastrophic losses from which it will be exceedingly challenging to recover. Leverage can boost your earnings, but it also has the potential to deplete your account balance. Some brokers provide leverage of up to 300:1, 500:1, or even 2,000:1.

5. Not using more than 5% of your trading money in a single transaction.

You must learn how to protect your trading capital if you want to know how to be profitable in Forex. Professional Forex traders methodically and slowly increase their trading balance. They control drawdown periods properly and avoid taking unnecessary risks. The majority of experienced traders only stake 1–5% of their trading account per transaction. Probabilities are the foundation of profitable and reliable trading. Results become reliant on a small number of trades that can either skyrocket or completely ruin your trading balance when you break that equilibrium and take on more risks.

6. Maintaining a trade journal

Trading notebooks aid traders in improving outcomes, identifying strengths and limitations in their trading techniques, and learning from their own mistakes. The majority of seasoned traders keep trading diaries of some kind. They force traders to take more responsible deals and maintain accountability. They also assist in avoiding opening pointless deals. And it makes sense that you would choose your trading settings more carefully and steer clear of errors if you were documenting your trades.

7. Carrying out routine fundamental research

Keeping up with current economic trends is the last step to maybe having continuously effective trading experiences. A trader can begin by studying the eight major currencies that make up the Forex Majors, paying attention to recent releases of the Gross Domestic Product (GDP), Consumer Price Index (CPI), Unemployment rate, and other significant data as well as interest rate decisions.

Reading an economic news article can protect your technical trades from excessive volatility and uncertainty, even if you want to day trade and avoid fundamental transactions. Currency pair movements are erratic due to political turmoil and impending economic news. In such situations, many technical traders refrain from making orders.

Conclusion

To sum up, learn how to be profitable in Forex can be beneficial, but investors must make sure they have a risk management in place together with suitable strategy, especially for beginners.